Our Tax Law Marketing Expertise

Timmermann Group’s tax law marketing expertise is dynamic and precise. We focus on strategies that highlight your firm’s ability to navigate complex tax laws, ensuring your message reaches businesses and individuals in need of expert tax legal advice.

Our Most Popular Tax Law Marketing Agency Services

Timmermann Group offers specialized marketing services tailored to the unique needs of tax law firms.

.

Search Engine Optimization (SEO)

Our SEO strategies are customized to showcase your firm's tax law expertise, ensuring high visibility for those seeking tax-related legal assistance.

Learn MorePay-Per-Click (PPC) Advertising

We develop PPC campaigns that precisely target individuals and businesses in need of tax law services, leading to more effective client engagement.

Learn MoreSocial Media Management

Our approach to social media involves sharing content that highlights your firm's knowledge in tax law, establishing your authority in the field.

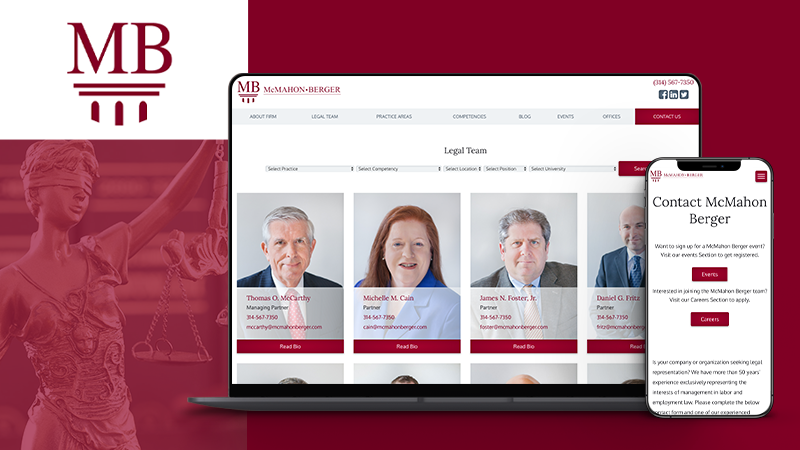

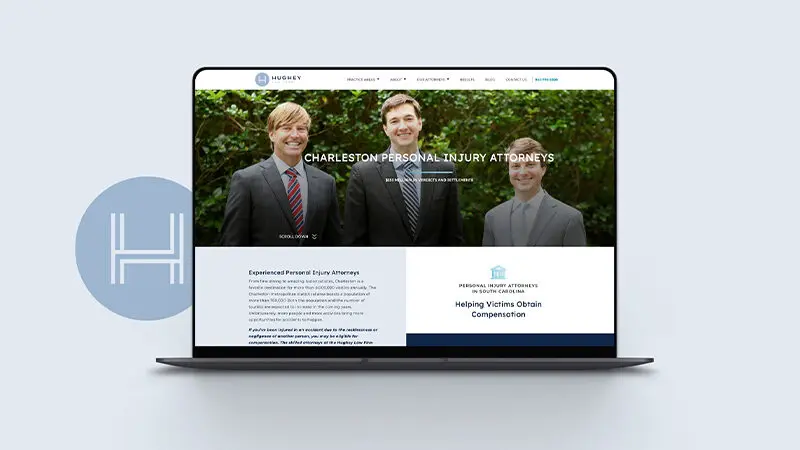

Learn MoreWebsite Design & Development

We create professional and informative tax law firm websites, showcasing your ability to handle complex tax legal issues effectively.

Learn MoreView Our Success Stories

Give your tax law firm the marketing agency it deserves.

It takes three steps to get started.

- Schedule a Consultation

- 30-min Intro Call

- Strategy Meeting + Proposal

Have a Question for Us? Reach Out.

Schedule a collaborative conversation with us today.

Have a Question About Tax Lawyer Marketing?

If you have a question about Timmermann Group’s marketing services and aren’t ready to schedule a free consultation, fill out this form and a member of our team will be in touch shortly.

Fill out the form below and a member of our team will respond shortly.

"*" indicates required fields

How to Choose the Right Tax Law Marketing Agency

Specialization in Tax Law Marketing Strategies:

Align with an agency that specializes exclusively in creating marketing strategies for tax law firms. This agency would understand the unique complexities of tax law, including federal, state, and international tax regulations, enabling them to develop customized marketing approaches that effectively reach and engage potential tax law clients.

Proven Results in Tax Law Marketing:

Select an agency that has achieved tangible results in penetrating the tax law market. Assess their performance through metrics such as lead generation, conversion rates, and client acquisition cost, ensuring their ability to effectively target and attract individuals seeking tax-related legal services.

Learn More About Tax Law Marketing

Discover the intricacies of Tax Law Marketing with Timmermann Group. Our expertly crafted section provides insights into the world of tax law marketing, with FAQs that cover essential strategies for reaching businesses and individuals in need of tax legal advice. Understand how to effectively showcase your tax law expertise, driving growth and client engagement.

What strategies work best for tax law marketing?

Effective tax law marketing should emphasize the firm’s expertise in complex tax matters. This includes creating content that demystifies tax laws and regulations and highlighting the firm’s ability to assist with various tax-related issues. Utilizing SEO to target specific tax-related queries and establishing a strong professional online presence are also key strategies.

How important is SEO for tax law firms?

SEO is crucial for tax law firms as it helps them appear in search results for those seeking tax legal advice. Optimizing for specific tax-related keywords and phrases can increase a firm’s visibility to potential clients, making it easier for them to find the firm’s services online.

Can content marketing benefit tax lawyers?

Yes, content marketing is highly beneficial for tax lawyers. By providing informative and insightful content on tax laws, changes in regulations, and tax planning tips, lawyers can establish themselves as authorities in the field. This helps build trust with potential clients and can lead to increased engagement and inquiries.

What should a tax law firm’s website feature?

A tax law firm’s website should be informative, professional, and user-friendly. It should include detailed service descriptions, attorney bios, client testimonials, and resources like blogs or guides on tax-related topics. Clear calls to action and easy-to-find contact information are also essential.

How do tax law firms measure the effectiveness of their marketing?

The effectiveness of marketing for tax law firms can be measured through various metrics such as website traffic, lead generation rates, client inquiries, and engagement with content. Regularly reviewing these metrics helps in understanding the impact of marketing strategies and identifying areas for improvement.